Inflation ≠ Price Rises. Inflation = Money Debasement. Which is why the statement below is wrong.

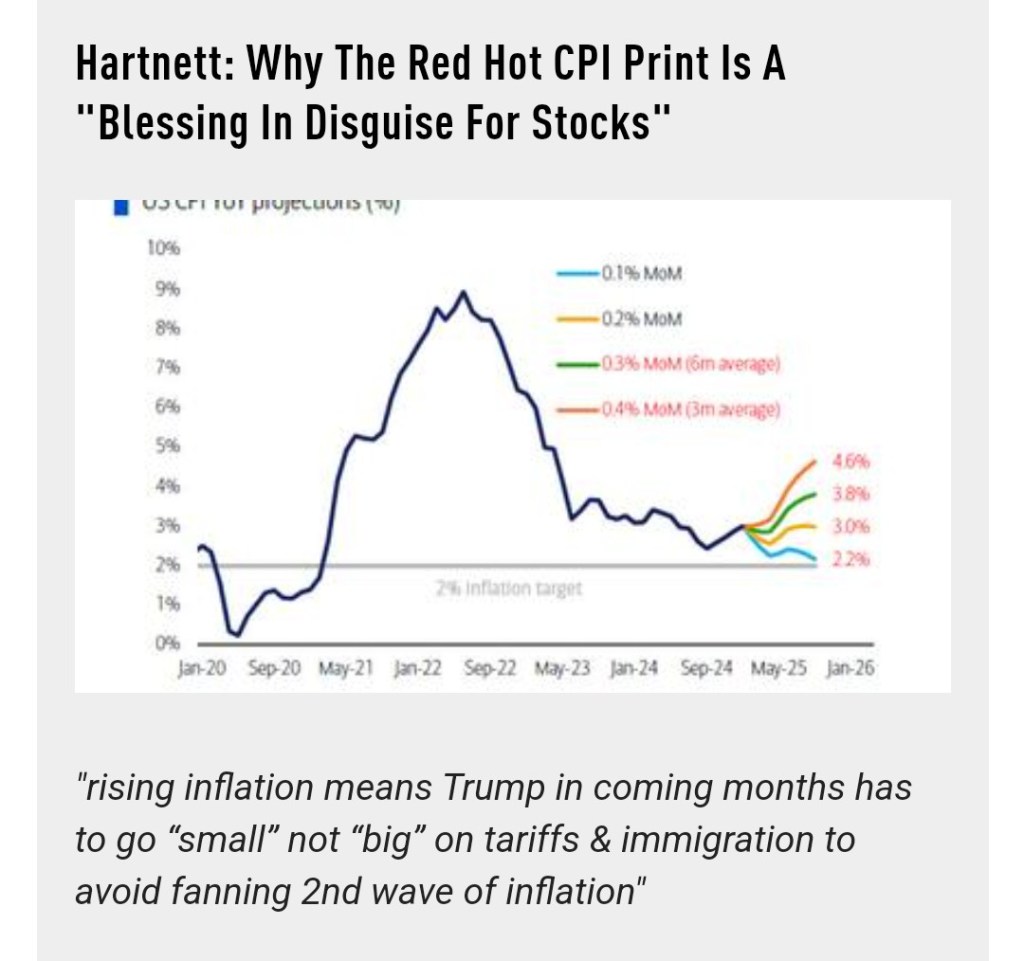

“rising inflation means Trump in coming months has to go “small” not “big” on tariffs & immigration to avoid fanning 2nd wave of inflation”

Tariffs and immigration limits are not money events: they are market events. “It’s all the same! Prices go up.” you may say. But (ceteris paribus) the market will adjust pricing and margins to reduce pricing to buyers, the tariff revenue will enable the reduction of income and other tax burdens, and fewer H1B immigrants will maintain domestic earning and spending power, whilst reducing unemployment cost.

Since China’s (wrongful) admission to the WTO, America has experienced significant monetary debasement, temporarily disguised by the lower pricing afforded by cheaper offshore labor and manufacturing. “Inflation” has still raged, largely unmeasured by government stats: CPI is a joke.

Utility bills, all those “convenience charges” added when you pay by credit card, local taxes, fees, gas and diesel, subscription fees, insurance, education – these are all way higher, more than offsetting the sugar rush of everything being made with lousy quality (shorter life, less utility) abroad.

The mass and chronic unemployment costs are borne by the people, whilst the extra profits were pocketed by the corporations. In a closed economy, profits would be reinvested in local production and services. In the WTO economic model with China (and Mexico, Canada) parasiting off the US economy, the profits were dissipated long ago, and the impoverished locals are reduced to buying foreign tat in Walmart.

We’ve had reduced consumer prices of this junk presented as “monetary stability”, but all the while the value of the dollar has been eroded.

The Federal Reserve’s solution to repeat crises is to give free money to the banksters so they can lend that money at usurious rates of interest to cash-strapped consumers. So Blackrock, Buffett, Gates & Co buy up the land and housing, using tax-sheltered free money, pumping devalued money into these markets, pricing American citizens out.

Bill Gates, Larry Fink, Warren Buffet, Nancy Pelosi, Janet Yellen – they don’t have inflation. Their dollars appreciate in value because of where they spend them, whilst the bottom 90% have seen their money devalued significantly since 1990, and the bottom 50% of American citizens have been bent over a barrel and given it hard.

3¢ in 1913 = $1 in 2025. That’s a money event.